Why visit ACE ’24?

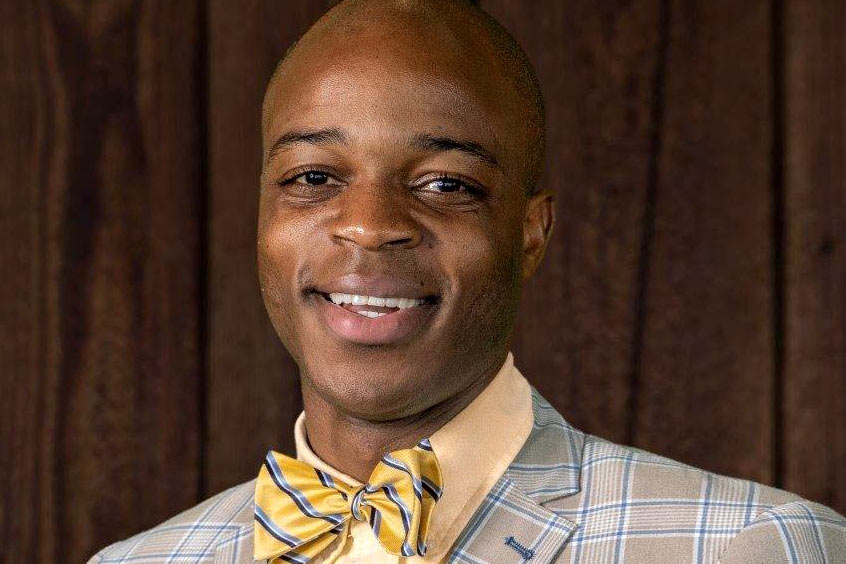

Aviation advisory and brokerage firm Mente Group has named Kenny Mazingo as market analyst, planning and transactions, based in the company's Dallas, Texas headquarters.

He is responsible for collecting, interpreting and analysing general aviation market data in order to support Mente's transactions and business development teams. In his role, Mazingo is also involved with developing marketing specifications, presentations, creating reports and client interaction.

“Kenny Mazingo brings a different and strong background to the Mente Group. A self-starter by nature, he is driven by his life-long faith and his passion for general aviation,” comments Brian Proctor, president and CEO. “With expansive knowledge and experience in the very light jet segment of the industry, he provides valuable data to inquiring brokers and research analysts.”

Mazingo was previously the aircraft sales associate for another reputable aircraft dealer, and the sales representative for a Part 145 repair station. He is also a member of the International Aircraft Dealer Association (IADA) researcher community, and speaks Portuguese, English and Spanish.